Not known Details About Guided Wealth Management

The Only Guide for Guided Wealth Management

Table of ContentsThe Guided Wealth Management PDFsSome Known Details About Guided Wealth Management What Does Guided Wealth Management Mean?The Buzz on Guided Wealth ManagementThe 8-Minute Rule for Guided Wealth Management

For investments, make repayments payable to the item service provider (not your consultant). Providing a monetary consultant total access to your account increases danger.If you're paying a continuous guidance charge, your adviser ought to review your financial circumstance and consult with you at the very least yearly. At this meeting, see to it you review: any changes to your goals, circumstance or finances (including modifications to your revenue, expenses or assets) whether the level of danger you fit with has changed whether your existing personal insurance coverage cover is best how you're tracking versus your objectives whether any kind of adjustments to legislations or monetary items could influence you whether you have actually obtained every little thing they assured in your contract with them whether you need any type of adjustments to your strategy Each year an advisor need to seek your composed grant bill you ongoing recommendations fees.

If you're moving to a brand-new advisor, you'll need to set up to transfer your monetary records to them. If you need assistance, ask your consultant to discuss the process.

The Ultimate Guide To Guided Wealth Management

As an entrepreneur or tiny organization owner, you have a whole lot going on. There are many responsibilities and costs in running a company and you certainly don't need an additional unneeded expense to pay. You need to carefully take into consideration the return on financial investment of any solutions you obtain to ensure they are rewarding to you and your service.

If you're one of them, you might be taking a substantial risk for the future of your company and yourself. You may wish to continue reading for a listing of reasons why employing an economic consultant is useful to you and your organization. Running a business teems with obstacles.

Cash mismanagement, cash money circulation troubles, overdue settlements, tax problems and various other economic issues can be crucial sufficient to close a business down. There are numerous methods that a qualified economic advisor can be your partner in helping your service prosper.

They can deal with you in evaluating your financial scenario often to prevent serious mistakes and to swiftly correct any poor money choices. The majority of small company owners use several hats. It's reasonable that you intend to save cash by doing some jobs on your own, however managing financial resources takes knowledge and training.

The Ultimate Guide To Guided Wealth Management

You need it to know where you're going, exactly how you're getting there, and what to do if there are bumps in the roadway. A good monetary expert can put with each other a comprehensive strategy to assist you run your company much more efficiently and prepare for abnormalities that occur.

A reputable and experienced economic advisor can direct you on the investments that are best for your business. Money Savings Although you'll be paying a financial expert, the long-term cost savings will certainly justify the price.

Lowered Anxiety As a service proprietor, you have whole lots of points to worry about. An excellent financial expert can bring you peace of mind knowing that your finances are obtaining the focus they require and your cash is being spent carefully.

9 Simple Techniques For Guided Wealth Management

Security and Growth A competent financial expert can provide you clarity and assist you concentrate on taking your business in the ideal direction. They have the tools and sources to employ tactics that will guarantee your service expands and thrives. They can aid you evaluate your goals and figure out the finest course to reach them.

The Best Strategy To Use For Guided Wealth Management

At Nolan Accounting Center, we offer competence in all aspects of economic preparation for little companies. As a little business ourselves, we know the difficulties you deal with every day. Offer us a phone call today to discuss just how we can aid your business grow and succeed.

Independent ownership of the technique Independent control of the AFSL; and Independent remuneration, from the customer only, through a set buck charge. (http://www.askmap.net/location/7116058/australia/guided-wealth-management)

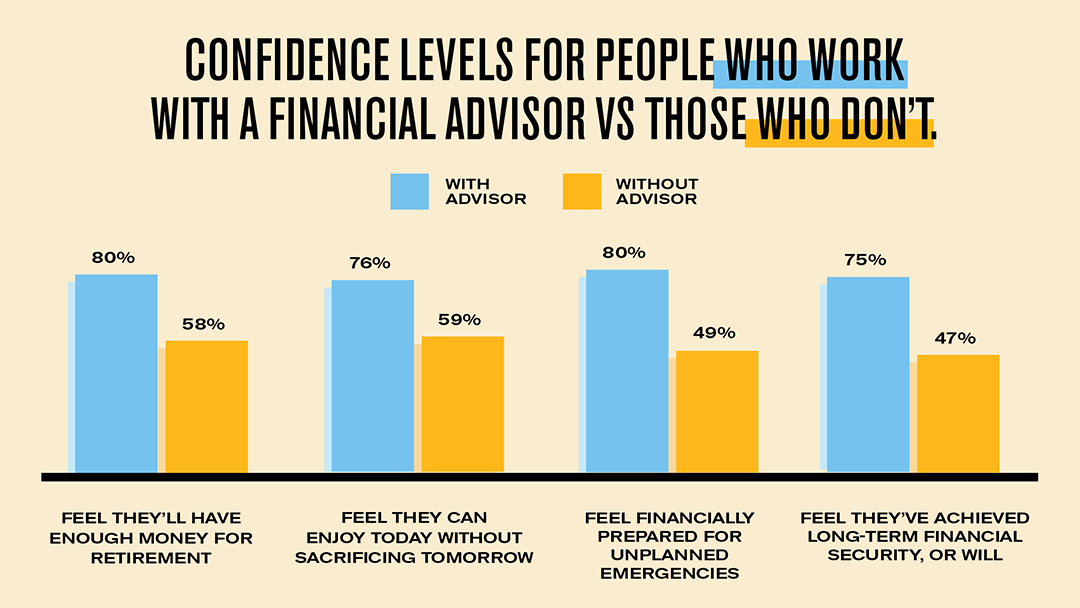

There are various benefits of a financial planner, no matter of your situation. Despite this it's not uncommon for individuals to second guess their viability due to their position or existing financial investments. check these guys out The objective of this blog is to confirm why everybody can take advantage of a financial plan. Some typical worries you might have felt yourself include: Whilst it is easy to see why individuals might assume by doing this, it is certainly not appropriate to consider them correct.